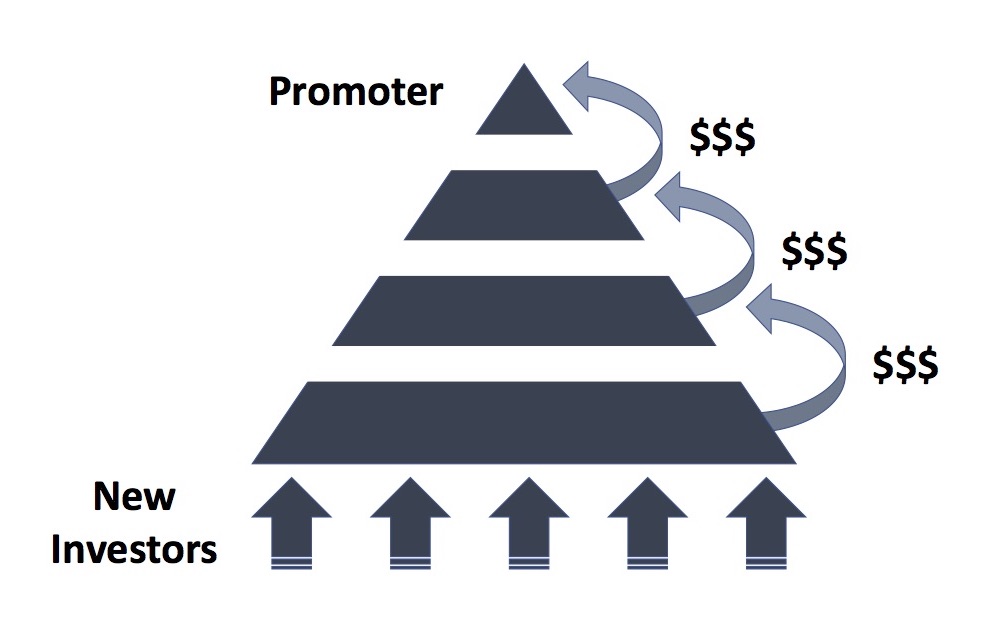

A Ponzi scheme is a type of fraudulent ‘pyramid scheme’ with multiple-investor structures whereby capital received from new investors is used to pay returns to existing investors, creating the illusion of high profitability.

The objective is for the company to build a reputation and encourage further investment, but ultimately when investment ceases the scheme will collapse causing everyone in the ‘pyramid’ to lose their money.

Given the nature of these schemes, it is likely that innocent traders can also become embroiled in an investigation and it is important that anyone affected seeks early legal advice from one of our expert investment fraud lawyers in order to achieve the best possible outcome for your case.

Penalties

The penalties incurred as a result of being involved in a Ponzi Scheme are wide ranging and can carry a custodial sentence of up to ten years and/or an unlimited fine. The punishment imposed mainly depends on culpability, the level of harm that has been committed or intended and the impact on the victim. The offence carries additional risks if you are a company director as you could be disqualified from regulated activity for life by the Financial Conduct Authority (The FCA). The FCA also has the power to issue a confiscation order and/or a financial reporting order or a serious crime prevention order. There is nothing to prohibit a civil claim following a criminal claim, or vice versa and both can occur simultaneously. Our lawyers have the experience and knowledge to act for clients in either capacity.

The Next Step

Our experienced team of serious fraud lawyers have the expertise, resources and knowledge to advise clients facing allegations of operating a Ponzi Scheme even before a charge has been brought. Contact our expert investment fraud solicitors on 020 3666 5155 or email us on enquiries@sperrin.net